HM Revenue & Customs published their latest tax gap estimates yesterday. These cover the tax year 2023/24.

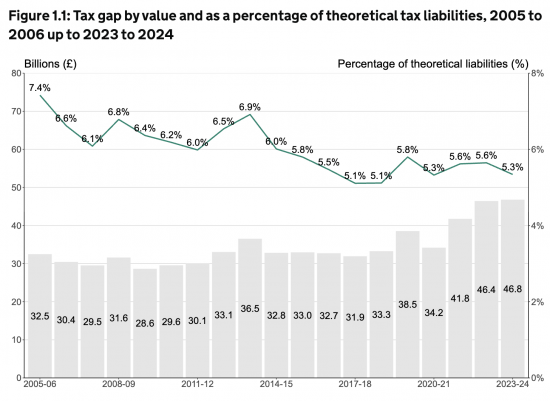

The summary data looks like this and presents the usual picture that they have now delivered for more than a decade, which is that everything looks to be under control, and the tax gap is around 5% of total estimated tax receipts.

I have, over a very long period of time and in many articlesdisputed whether HMRC prepare appropriate tax information.

Not only do I think they should estimate better tax gap estimates, for reasons that I explain in this article I also believe that those that those that they calculate for tax avoidance, tax evasion and unpaid tax are insufficient, because there are also tax gaps arising as a consequence of policy decisions, e.g. choosing not to tax wealth, and because of excessive tax allowances and relief, which are issues I explore at length in the Taxing Wealth Report. HMRC have never gone near addressing these issues, meaning that their analysis is decidedly partial in its scope.

I have also long suggested that the sample base used by HMRC for many of their estimates, is too small, and in any cases uses as the data for analysis information submitted to it, rather than that which is not submitted at all, which is where most of the tax shortfall will arise. I can still see no real effort being made to overcome this issue.

In practice, even the calm headline data from HMRC cannot disguise the fact that there are some massive underlying problems in its operations. This chart shows the gap by tax:

It is very obvious that even HMRC has had to admit that it has lost control of corporation tax collection since 2017.

As this table shows, corporation tax now contributes 40% of the tax gap, whereas not long ago, VAT was the dominant issue and income tax rivalled it.

Amongst my many concerns I have with the tax gap data are the apparent behavioural implications of this data. I know that the so-called ‘Making Tax Digital’ declaration system has supposedly improved VAT compliance, as I have been told by officials at HMRC, but frankly, I don’t entirely believe them. If the small business sector is totally out of taxz control as it seems to be, giving rise to the loss of corporation tax which is very obvious from this data, then there is little chance that the VAT that is owed by the small business sector is also being paid in a much more compliant fashion, as this chart would imply, and similarly, if small businesses are not paying their corporation tax bills you can guarantee that the PAYE liabilities that it owes are also being evaded. One of my repeated criticisms of HMRC is this persistent treatment of tax gaps as if they happen in silos by tax when it is very obvious that there are spillovers between these tax gap estimates, which connections do not appear to be made by HMRC.

As this chat shows, small business creates the vast majority of the tax gap, but with large businesses being the next single largest group.

I find the supposed tax compliance of the wealthy hard to believe, given research that has been undertaken elsewhere and the continued availability of tax havens.

A number of other tables that were published stand out. For example, this is the date with regard to corporation tax, showing just how quickly HMRC has lost control of this tax:

The fact that this has happened in tandem with the closure of the vast majority of smaller tax offices by HMRC, and at the time that it withdrew from undertaking active visits to smaller businesses, suggest to me that this massive loss is the consequence of mismanagement by HMRC, whose directors appear to have failed to understand the likely behavioural response of small businesses when they realised that the risk of being scrutinised by HMRC had, effectively, disappeared. The cost of that error of judgement is now very apparent.

This can be seen in this analysis of the corporation tax loss, which makes clear that 40% of all corporation tax due by smaller businesses is not now paid, either as a consequence of fraud or because the companies cease to exist before payment can be collected .

I haveargued for decades that limited liability in the UK has almost been designed to create opportunities for tax fraud, and HMRC’s own data now proves how right I have been. I wish they had listened. I gave them ample warning on many occasions.

Worryingly, as this chart shows, HMRC is also failing to predict the total corporation tax gap, and the actual losses it is incurring are bigger than those that they estimate in advance.

It would appear that lessons are not being learned. Not only are current year losses being reported likely to be understated as a result, but the actual loss is already at least £14.7 billion. If losses had simply been contained at the levels seen until around 2017, they would be half that sum, and there would be no pressure for massive cuts in the disability and other benefits payments that are now under discussion. Labour really does have to take note, and act.

The other area where I think it is glaringly obvious that HMRC’s decision to withdraw from local presence has had disastrous consequences is with regard to small business taxation. The supposed tax gap with regard to income tax and related taxes, such as national insurance and capital gains, is claimed to be at an all-time low of around 3%.

However, this is not true when it comes to self assessment, where the gap is more than 12%, as this table shows.

When the source of income under-declared is analysed, it is apparent that small business income under-declared amounts to nearly 23% of the actual liabilities owing.

In other words, fraud is not just prevalent amongst small businesses that are incorporated, but also amongst those that are run by people in their own names. They, like companies, now have no real fear of HMRC investigating affairs, because HMRC does not have the resources to do so.

I could analyse other parts of the HMRC report, and in many cases I think that would show that there are likely to be underestimates of tax gaps incurred, but to me, the most important point that I note here is that I predicted all these problems long ago.

I campaigned against the closure of local tax offices from 2010 onwards, working with unions representing HMRC staff.

I have for over two decades highlighted the fraudulent use of small companies in the UK, and continually asked why more effort was not being put into collecting tax from these companies, including putting into place arrangements so that banks would have to notify HMRC of which companies were actually trading in this country, which bizarrely does not happen, and putting in place arrangements to remove the limited liabilities of companies that were being used for very obviously fraudulent purposes so that tax could be collected from directors who have approved abuse the system for personal gain. I even wrote legislation on this issuewhich was presented to parliament, but nothing happened.

And, I warned that cutting HMRC staff with sufficient experience, working in local tax offices, and knowing the local scene, would have disastrous consequences, and so it has turned out to be. I hate to sound like a worn out record, but until HMRC puts people on the ground in local tax offices in every major town and city in the UK, and requires that those staff actually go out to inspect the books and records of small businesses, they have no chance of beating the enormous levels of fraud that are taking place in the UK economy with regard to tax.

We have a choice to make, or rather, our politicians do. They currently allow small businesses to operate in a criminogenic environment, where dishonest businesses are persistently undermining the opportunities that honest businesses seek to create. This happens because they support the cheats by refusing to collect the tax that they owe. If they want a strong, vibrant, small business sector in the UK, they have to collect tax from everyone and make it clear that is their intention. If they don’t, we will end up with an economy based on cheating and corruption.

Right now, every politician needs to explain why they have chosen to support the cheats, and not honest taxpayers, because that is what they have done. It is time they changed their tune.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog’s glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog’s daily email here.

And if you would like to support this blog you can, here: