A class action lawsuit has recently been filed against Michael Saylor and his company Strategy regarding Bitcoin investments and related financial advice. At the time of writing, several investors have actually joined together to allege that they were, in fact, misled about cryptocurrency performance and potential returns. This lawsuit follows increased criticism of the digital currency and investment market.

JUST IN: Class action lawsuit filed against Michael Saylor’s ‘Strategy,’ alleging misleading statements about its Bitcoin strategy.

— Watcher.Guru (@WatcherGuru) May 19, 2025

Also Read: India Rejects Global South’s De-Dollarization Agenda: “Absolutely No Interest”

Michael Saylor’s Strategy Faces Lawsuit Over Bitcoin and Cryptocurrency Claims

The class action lawsuit essentially centers on claims that Strategy provided somewhat misleading information about Bitcoin investments. According to recently filed court documents, multiple investors have now joined the legal action, alleging significant losses from following the company’s cryptocurrency investment advice.

Key Allegations in the Class Action Lawsuit

Plaintiffs in the class action lawsuit allege that Strategy and also Saylor himself exaggerated Bitcoin returns while downplaying cryptocurrency market volatility. The legal filing specifically mentions various public statements regarding Bitcoin as an alternative to the United States dollar and other traditional currency options.

The class action lawsuit also contends that Strategy failed to disclose certain relevant conflicts of interest related to cryptocurrency holdings and investment positions.

Also Read: Pepe Whales Start Accumulating: $0.00002 In The Cards?

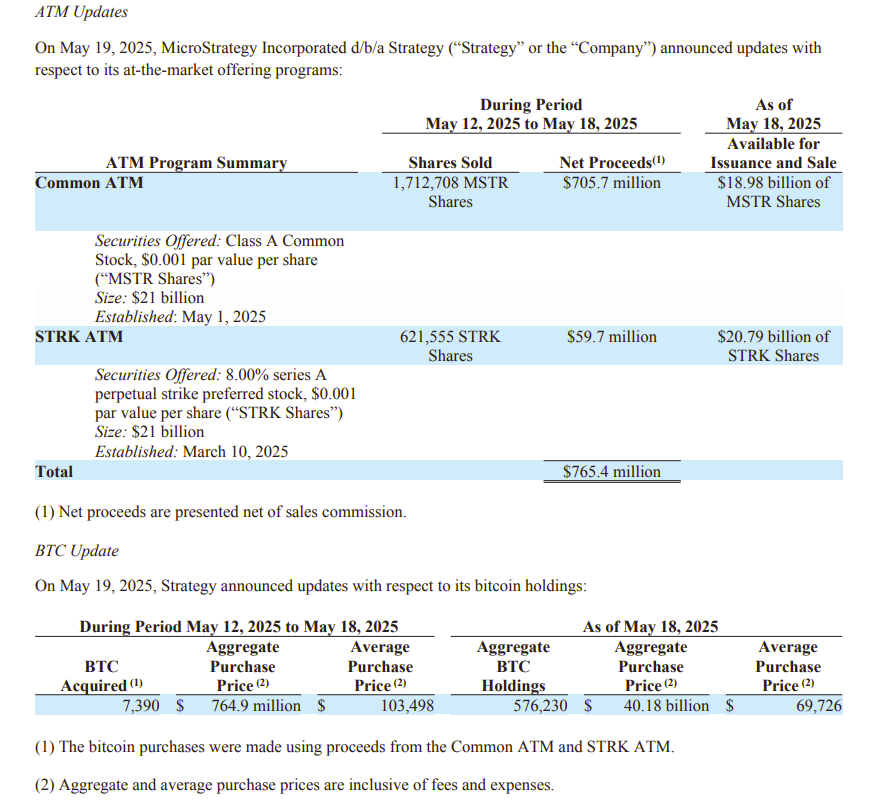

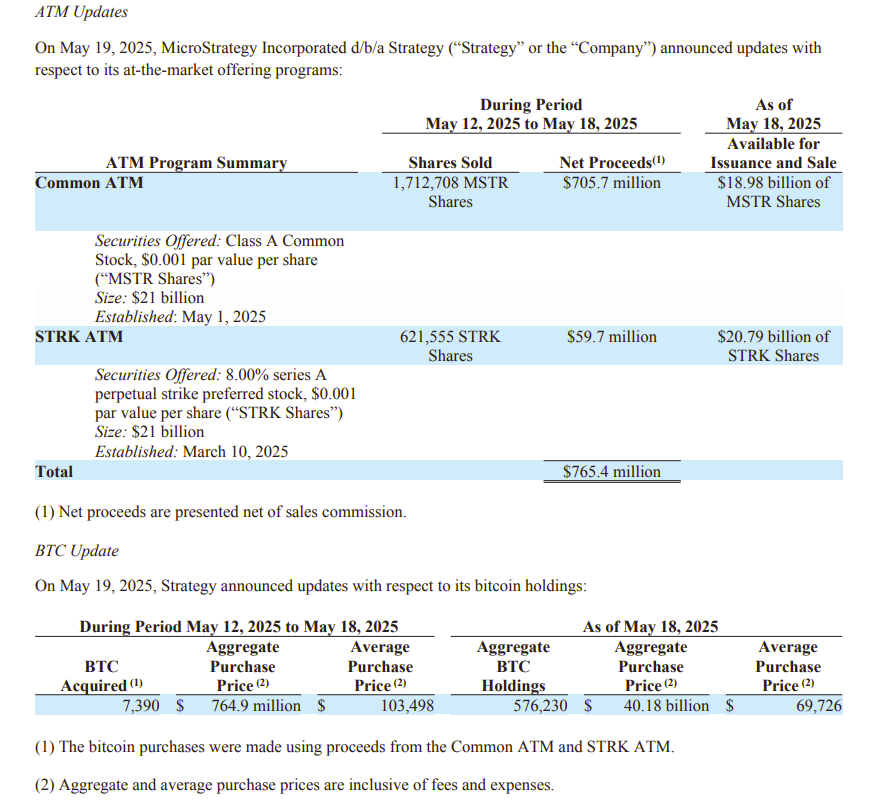

Saylor’s Bitcoin Strategy

Saylor has been, for quite some time now, a rather prominent Bitcoin advocate in the corporate world. His company gained considerable attention when it began converting substantial treasury reserves into cryptocurrency. This particular strategy was actively promoted as protection against currency devaluation, which has led to rather substantial Bitcoin holdings that have attracted both praise and criticism from financial analysts.

Market Implications

It could impact the way companies market their crypto investments to anyone considering an investment in this field in the future. Experts in finance and the government monitor what is going on. At this point, a lot of interest in cryptocurrency networks and blockchain technology has appeared because people are showing an interest in local currency alternatives and options outside the BRICS.

Also Read: JPMorgan Kinexys Drives $2B Tokenized Settlement With Chainlink

Right now, strategy is dealing with several lawsuits that cryptocurrency proponents have encountered. Throughout the next several months as the case develops in court, it could determine rules for revealing information in Bitcoin and cryptocurrency markets.